Owning a home is a dream many of us strive to achieve. It’s a place where we create memories, find solace, and build our lives. However, along with the joys of homeownership come responsibilities and uncertainties. Ensuring the protection of this precious investment is paramount, and that’s where homeowners insurance comes into the picture. This comprehensive coverage safeguards your home and its contents against unexpected incidents, providing you with peace of mind.

While car insurance or auto insurance is a familiar concept to most, homeowners insurance can often be overlooked or misunderstood. Its significance cannot be overstated, as it serves as a financial safety net when things go awry. From natural disasters to break-ins or accidents, homeowners insurance shields you from the financial burden that can arise from these unfortunate events.

Now that we understand the importance of homeowners insurance, let’s delve deeper into this topic to unravel its complexities and learn how it can safeguard your most valuable asset. Whether you’re a first-time homeowner or a seasoned property owner, this ultimate guide will equip you with the knowledge and insights you need to make informed decisions and ensure your home is adequately protected. So, let’s begin this journey towards securing your haven and safeguarding your peace of mind.

Understanding Homeowners Insurance

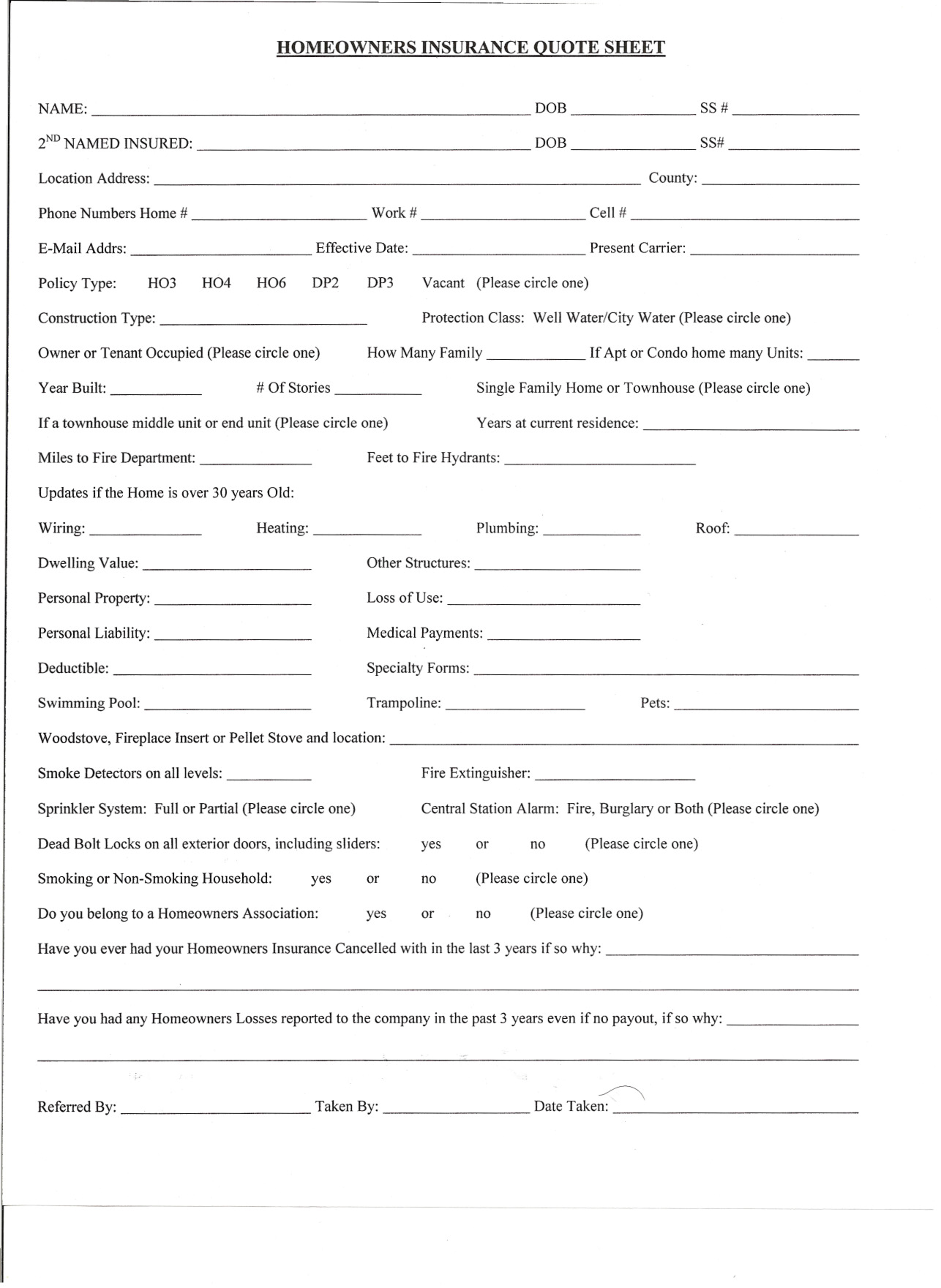

Homeowners insurance is a vital form of protection for homeowners, providing coverage for unexpected events and damages to your property. It is essential to understand the ins and outs of homeowners insurance to ensure you have the right coverage for your needs.

-

What is homeowners insurance?

Homeowners insurance is a type of insurance that provides financial protection in case of damage or loss to your home and its contents. It typically covers the physical structure of your house, as well as personal belongings inside, and may also provide liability coverage if someone gets injured on your property. -

What does homeowners insurance cover?

Homeowners insurance coverage can vary depending on the policy and provider, but it generally includes protection against perils such as fire, theft, vandalism, and certain natural disasters. It may also cover additional living expenses if you are temporarily displaced from your home due to a covered event. -

How is homeowners insurance different from car insurance or auto insurance?

While homeowners insurance focuses on protecting your property and personal belongings within your home, car insurance or auto insurance is specifically designed to cover risks associated with your vehicle. Car insurance typically includes coverage for damages to your vehicle, liability for injuries or damages caused to others, and may have additional options for comprehensive coverage or personal injury protection.

Remember, it’s important to review your homeowners insurance policy carefully to understand the specific coverage, deductible, and limits. It is also a good idea to regularly evaluate and update your policy as your needs change over time.

Benefits of Car Insurance

Car insurance provides numerous benefits, ensuring peace of mind and financial security for vehicle owners. Whether you own a car for personal use or have a fleet for business purposes, having car insurance is essential. Here are three key advantages of having car insurance:

-

Financial Protection: Car accidents can result in costly damages, including repairs or replacement of vehicles, medical expenses, and legal fees. With car insurance, you can protect yourself from bearing the entire financial burden in such situations. Depending on the coverage you select, your insurance policy can help cover these expenses, minimizing your out-of-pocket costs.

-

Legal Compliance: In many jurisdictions, having car insurance is mandatory by law. By having the appropriate insurance coverage, you can ensure that you meet your legal obligations as a vehicle owner. This not only helps you avoid potential fines or penalties, but it also provides proof of financial responsibility in case of accidents or other incidents involving your vehicle.

-

Peace of Mind: Car insurance offers invaluable peace of mind, knowing that you are financially protected in case of unforeseen events. Whether it’s a minor fender bender or a major collision, knowing that your insurance will help cover the costs can reduce stress and anxiety associated with accidents. This allows you to focus on the well-being of yourself and your loved ones without worrying about the financial aftermath.

Overall, car insurance provides essential benefits that go beyond mere financial protection. It ensures legal compliance, provides peace of mind, and allows you to drive with confidence, knowing that you are well-prepared for any unfortunate circumstances on the road.

Important Considerations for Auto Insurance

When it comes to protecting your vehicle, having the right auto insurance is essential. Here are some important considerations to keep in mind:

-

Coverage Options: When choosing auto insurance, it’s important to understand the different coverage options available. Liability coverage helps protect you financially if you are at fault in an accident, while comprehensive coverage can provide protection against theft, vandalism, and other non-collision incidents. Collision coverage, on the other hand, helps cover the cost of repairs or replacement if your vehicle is damaged in a collision.

- Auto Insurance Grand Rapids Mi

Deductibles and Premiums: Another important consideration is the deductible and premium amounts associated with your auto insurance policy. The deductible is the amount you will have to pay out of pocket before your insurance kicks in, while the premium is the amount you pay for the coverage. Consider your budget and choose deductibles and premiums that you are comfortable with.

-

Discounts and Savings: Many insurance providers offer discounts and savings opportunities that can help lower your auto insurance costs. These may include discounts for safe driving records, multiple policies with the same insurer, or the installation of safety features in your vehicle. Be sure to inquire about these discounts and take advantage of any that you may be eligible for.

Remember, just like homeowners insurance, having the right auto insurance coverage can provide you with peace of mind and financial protection. Take the time to carefully consider your options and choose a policy that meets your needs and budget.