Are you a homeowner looking to safeguard your haven? In the unpredictable world we live in, having a reliable home insurance policy is becoming ever more essential. Whether it’s the threat of natural disasters, unforeseen accidents or the risk of burglary, having the right coverage can provide you with the peace of mind you deserve. However, navigating the world of home insurance can be confusing, with numerous terms and options to consider. That is why we have crafted this ultimate guide to home insurance, to simplify the process and help you make the best decision for protecting your beloved home. Let us delve into the intricacies of home insurance and discover how you can secure your investment for years to come.

Types of home insurance

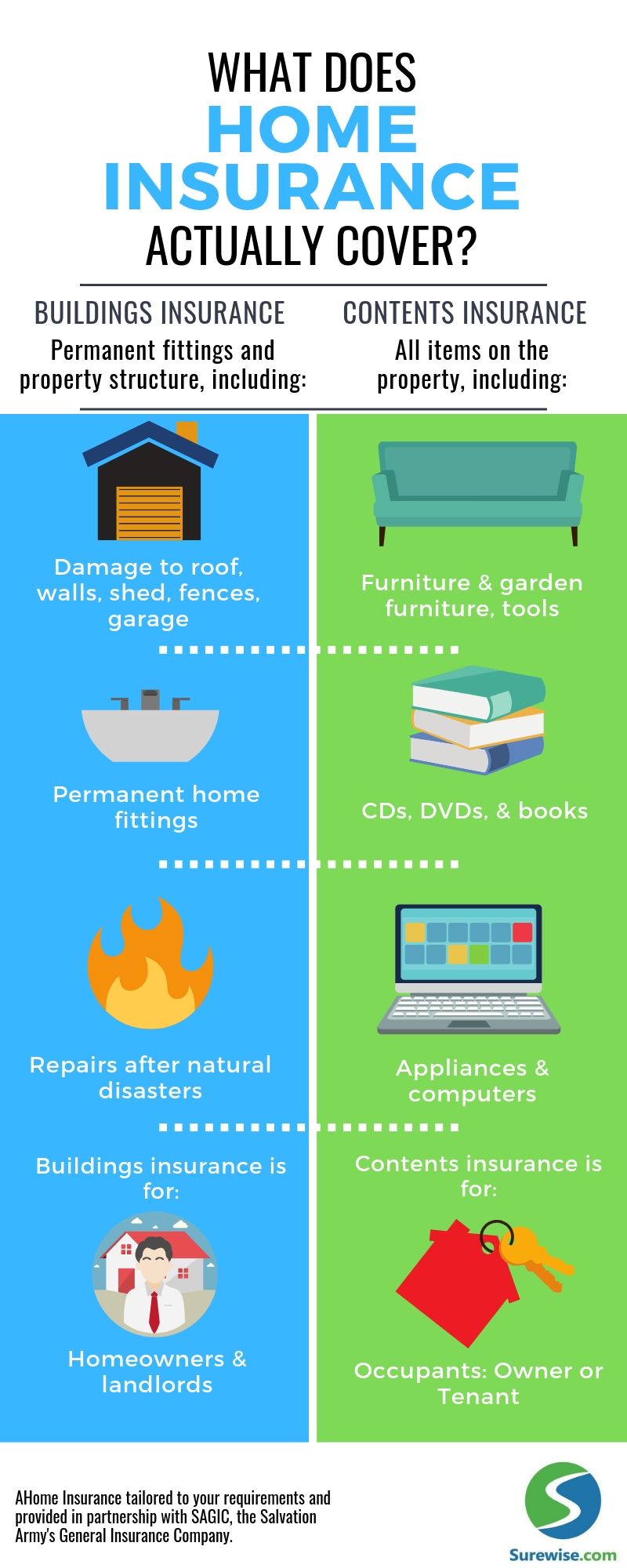

When it comes to protecting your haven, home insurance plays a vital role. It provides coverage for your property and personal belongings in the event of unexpected events. Understanding the different types of home insurance is crucial in ensuring you have the right coverage for your needs. In this section, we will explore the various types of home insurance policies available.

-

Homeowner’s Insurance: This is the most common type of home insurance policy. It provides coverage for your home and other structures on your property, such as garages or sheds. Additionally, homeowner’s insurance also offers liability coverage in case someone is injured on your property.

-

Renter’s Insurance: Designed specifically for those who rent their homes, renter’s insurance provides coverage for personal belongings and liability protection. While the landlord’s insurance typically covers the structure of the building, renter’s insurance ensures that your possessions are protected against theft, fire, or other covered perils.

-

Condo Insurance: If you own a condominium, condo insurance is a must-have. This type of insurance provides coverage for your unit and any improvements you make, such as renovations or upgrades. It also includes liability protection and coverage for personal possessions.

Remember, each type of home insurance policy may vary in terms of coverage and cost. It is essential to carefully evaluate your needs and consult with an insurance professional to determine the best policy for your unique situation. By choosing the right type of home insurance, you can have peace of mind knowing that your haven is protected.

Coverage options and limits

When it comes to home insurance, having the right coverage options and understanding the limits is crucial. It ensures that your haven is protected and that you have peace of mind. Let’s delve into the different coverage options available and the importance of knowing the limits.

-

Dwelling Coverage: This is the primary component of your home insurance policy. It provides protection for the physical structure of your home, including the walls, roof, floors, and built-in appliances. Make sure you choose a dwelling coverage limit that accurately reflects the cost of rebuilding your home in the event of a total loss. This is important to ensure you have sufficient coverage to restore your haven to its former glory.

-

Personal Property Coverage: Your home is filled with valuable possessions that hold sentimental and monetary value. Personal property coverage safeguards your belongings, such as furniture, electronics, and clothing, against loss or damage caused by covered perils. Take inventory of your personal belongings and consider their total worth to determine the appropriate coverage limit. Remember, these items are what make your house a home, so protecting them is essential.

-

Liability Coverage: Accidents can happen anywhere, even within the confines of your home. Liability coverage is intended to shield you from legal and financial responsibilities if someone is injured on your property or if you accidentally damage someone else’s property. This coverage can help with medical expenses, legal fees, and potential settlements. It’s a vital component of home insurance that helps safeguard your haven and your financial well-being.

Understanding the coverage options and limits provided by your home insurance policy is crucial in ensuring that you are adequately protected. Take the time to review your policy, assess your needs, and communicate with your insurance provider to make any necessary adjustments. By having the right coverage in place, you can rest easy knowing that your haven is protected against life’s uncertainties.

Choosing the right home insurance policy

When it comes to safeguarding your haven, selecting the right home insurance policy is crucial. With various options available, it’s important to consider your specific needs and make an informed decision.

Firstly, assess the coverage types offered by different home insurance policies. Some policies may focus solely on protecting the structure of your home, while others may also offer coverage for personal belongings and liability. Carefully review the coverage details to ensure they align with your requirements.

Secondly, consider the deductibles and premiums associated with each policy. A deductible is the amount you’ll need to pay out of pocket before your insurance coverage kicks in. Generally, higher deductibles result in lower premiums and vice versa. Evaluate your financial flexibility and choose a deductible and premium combination that suits your budget.

Lastly, take note of any additional benefits or add-ons offered by the insurance policies you’re considering. These may include coverage for natural disasters, vandalism, or identity theft, among others. Assess your location, potential risks, and personal circumstances to determine which add-ons would provide you with the most valuable protection.

By following these steps and considering your specific requirements, you’ll be on your way to selecting the perfect home insurance policy that provides peace of mind and comprehensive coverage for your haven.