Running a business comes with a multitude of responsibilities, and one crucial aspect that cannot be overlooked is understanding and navigating business tax law. For many, the complexity of the Internal Revenue Service (I.R.S.) can seem daunting, leaving entrepreneurs feeling overwhelmed and uncertain about where to begin. However, fret not, as this article aims to demystify the I.R.S. and simplify the intricate realm of business tax law. By breaking down the key concepts and offering expert guidance, we hope to equip you with the knowledge necessary to confidently navigate the ever-changing landscape of business tax regulations. So, put your worries aside and let’s embark on this enlightening journey through the world of business tax law.

Understanding Business Tax Obligations

When it comes to running a business, understanding your tax obligations is crucial. Failing to comply with the requirements set forth by the Internal Revenue Service (IRS) can lead to penalties and legal consequences. In this section, we will demystify business tax law and help you navigate through the complex world of tax obligations.

The first step in understanding your business tax obligations is determining your entity type. Different business structures, such as sole proprietorships, partnerships, corporations, and LLCs, have different tax responsibilities. It is essential to know how your business is classified for tax purposes to ensure you are meeting the correct requirements.

Next, you need to ensure that you are aware of the tax filing deadlines. The IRS has specific deadlines for different types of taxes, such as income tax, payroll tax, and sales tax. Missing these deadlines can result in costly penalties, so it is crucial to stay organized and submit your tax returns and payments on time.

Lastly, keeping accurate records is vital for meeting your tax obligations. It is essential to maintain detailed financial records, including income, expenses, and receipts. These records will not only help you file your taxes correctly but also serve as evidence in case of an IRS audit. Taking the time to establish good record-keeping practices will save you from unnecessary stress and potential legal issues in the future.

By understanding your business tax obligations, knowing your entity type, meeting filing deadlines, and maintaining accurate records, you can navigate the world of business tax law with confidence. In the following sections, we will delve deeper into specific aspects of business tax law and provide you with a comprehensive guide to ensure compliance and success in managing your business taxes.

Navigating Tax Deductions and Credits

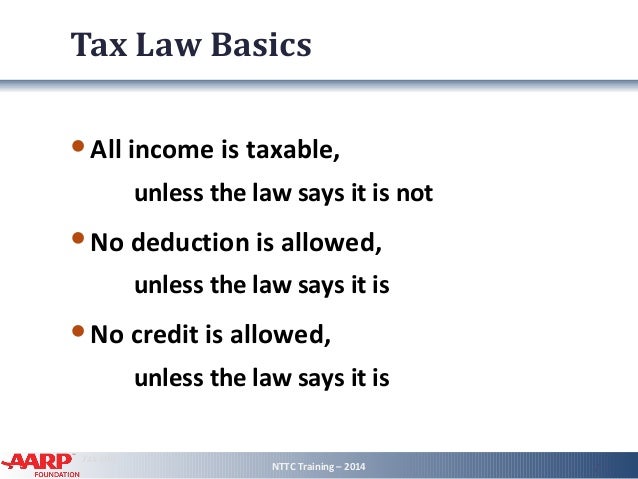

Understanding tax deductions and credits is essential for businesses to maximize their savings and minimize tax liabilities. In this section, we will demystify the concept of tax deductions and credits, helping you navigate through the complex landscape of business tax law.

-

Tax Deductions:

Tax deductions are expenses that businesses can subtract from their taxable income, ultimately reducing the amount of taxes owed. Common tax deductions for businesses include costs related to operating expenses, employee salaries and benefits, interest on business loans, and depreciation of assets. By taking advantage of these deductions, businesses can lower their taxable income, resulting in substantial savings. -

Tax Credits:

Unlike deductions, which reduce taxable income, tax credits directly reduce the amount of tax owed. This makes tax credits highly valuable for businesses, as they can provide a dollar-for-dollar reduction in tax liabilities. Some common business tax credits include research and development credits, energy efficiency credits, and credits for hiring certain types of employees. It’s important to note that tax credits have specific eligibility requirements, so businesses must ensure they meet the criteria to claim them. -

Navigating the Process:

To effectively navigate through the process of identifying tax deductions and credits, businesses should maintain accurate and organized financial records. It is crucial to keep track of all expenses, receipts, and documentation related to potential deductions and credits. Additionally, seeking professional assistance from tax advisors or certified public accountants can be beneficial in ensuring businesses take full advantage of available tax benefits while remaining compliant with tax laws and regulations.

By understanding the nuances of tax deductions and credits, businesses can optimize their tax planning strategies, reduce their tax burden, and ensure compliance with business tax law. Being proactive in exploring potential deductions and credits can lead to significant financial savings, ultimately contributing to the overall success of the business.

Complying with IRS Reporting Requirements

When it comes to complying with IRS reporting requirements, businesses need to ensure that they adhere to specific guidelines in order to stay in line with tax laws. Fulfilling these requirements is crucial to avoid any penalties or legal issues. Below are some essential points to consider:

-

Maintaining Accurate Financial Records: Businesses must maintain accurate and up-to-date financial records. This includes proper bookkeeping, regularly updating records of income and expenses, and keeping receipts and invoices organized. By doing so, businesses will be well-prepared to meet IRS reporting requirements.

-

Meeting Filing Deadlines: It is vital for businesses to be aware of the various deadlines for filing their tax returns and other related forms. These deadlines vary depending on the type of business entity and the specific tax year. Missing these deadlines can result in penalties and unwanted attention from the IRS.

-

Reporting Income and Deductions: Accurate reporting of income and deductions is crucial, as any discrepancies can trigger audits or other inquiries from the IRS. Businesses should ensure that all income from various sources, such as sales, services rendered, or investments, is properly reported. Additionally, tax deductions that the business is eligible for should be claimed appropriately.

By understanding and complying with IRS reporting requirements, businesses can navigate the complexities of business tax law with confidence, ensuring compliance and avoiding unnecessary difficulties.